All Categories

Featured

Table of Contents

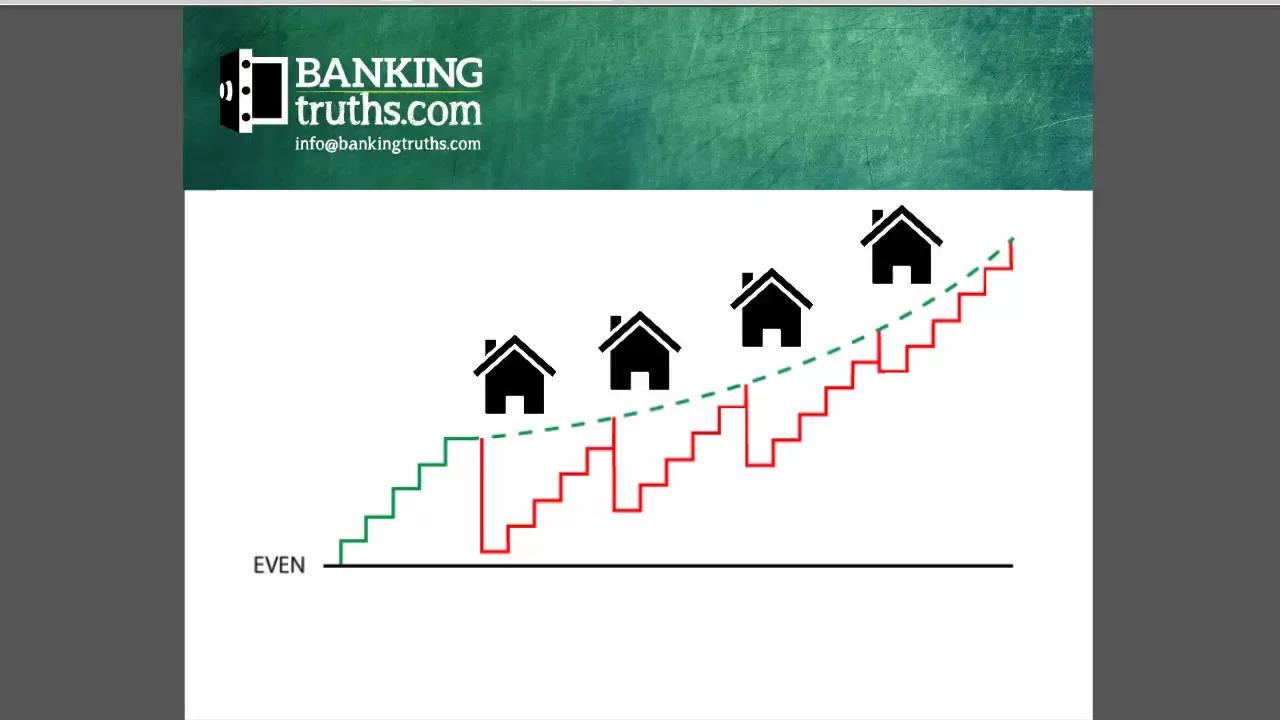

Entire life insurance policy policies are non-correlated assets. This is why they function so well as the economic structure of Infinite Financial. No matter what takes place in the market (supply, real estate, or otherwise), your insurance plan preserves its well worth. Also numerous people are missing this crucial volatility barrier that assists shield and expand wide range, rather splitting their money into two pails: savings account and financial investments.

Market-based financial investments expand wide range much quicker yet are exposed to market variations, making them inherently risky. What if there were a 3rd container that offered safety but also modest, guaranteed returns? Entire life insurance policy is that 3rd bucket. Not just is the rate of return on your entire life insurance plan guaranteed, your death advantage and premiums are additionally assured.

Infinite Financial charms to those seeking higher financial control. Tax effectiveness: The cash worth expands tax-deferred, and policy car loans are tax-free, making it a tax-efficient tool for building wealth.

Possession security: In numerous states, the cash money worth of life insurance policy is protected from financial institutions, adding an added layer of monetary safety. While Infinite Financial has its benefits, it isn't a one-size-fits-all service, and it includes significant downsides. Here's why it might not be the most effective method: Infinite Banking usually needs detailed plan structuring, which can perplex policyholders.

Infinite Bank

To develop a good policy that functions well for the Infinite Financial Principle, you need to lessen the base insurance policy in the policy and boost the paid-up insurance biker. It's not tough to do, but payments are paid straight in connection with just how much base insurance coverage is in the policy.

Some agents are willing to cut their commission to create a good policy for the client, yet many agents are not. However, several life insurance policy agents told their consumers that they were writing an "Infinite Banking Policy" yet wound up writing them a poor Whole Life insurance policy plan, and even worse, some sort of Universal Life insurance policy, whether it was a Variable Universal Life insurance coverage plan or an Indexed Universal Life insurance coverage policy.

An additional risk to the idea came because some life insurance policy representatives started calling life insurance policy policies "financial institutions". This language caught the interest of some state regulators and constraints ensued. Things have changed over the last a number of years - my wallet be your own bank. The IBC is still about, and it still functions. Mr. Nash's son-in-law, David Stearns, still runs the firm Infinite Financial Concepts, which to name a few things, offers guide Becoming Your Own Lender.

Royal Bank Infinite Avion Travel Rewards

You can check out my Daddy's ideas on that here. IBC is typically called "unlimited" as a result of its flexible and diverse method to individual financing administration, specifically with the use of whole life insurance policy plans. This principle leverages the cash value part of whole life insurance policy plans as an individual banking system.

This access to funds, for any reason, without needing to certify for a car loan in the standard sense, is what makes the idea seem "unlimited" in its utility.: Making use of policy financings to finance company obligations, insurance, fringe benefit, or perhaps to inject capital right into collaborations, joint endeavors, or as a company, showcases the flexibility and boundless potential of the IBC.

As always, utilize discernment and regard this recommendations from Abraham Lincoln. If you are interested in limitless banking life insurance policy and are in the market to get a good policy, I'm biased, but I suggest our household's business, McFie Insurance policy. Not only have we concentrated on establishing good policies for usage with the Infinite Banking Principle for over 16 years, yet we likewise own and use the very same kind of policies personally.

Either method obtaining a 2nd point of view can be vital. Whole Life insurance is still the premier monetary asset.

I do not see that transforming anytime soon. Whether you want learning more about limitless banking life insurance policy or aiming to begin utilizing the idea with your own plan, contact us to schedule a totally free method session. There's a great deal of complication around financing; there's a lot to understand and it's annoying when you do not recognize sufficient to make the finest economic choices.

Infinite Banking Link

Discover much more concerning the infinite financial idea and exactly how to get going with unlimited financial. Infinite Financial idea focuses on a person that becomes their very own banker by collecting liquid cash worth within a properly designed long-term life insurance policy policy. You borrow cash versus it to pay or invest. In various other words, you are your very own banker.

To design a great policy that functions well for the Infinite Financial Principle, you have to lessen the base insurance policy in the policy and enhance the paid-up insurance coverage motorcyclist. It's not tough to do, however compensations are paid straight in relation to just how much base insurance policy is in the plan.

Some agents want to reduce their commission to design a great policy for the client, but many representatives are not. Sadly, numerous life insurance coverage agents told their customers that they were writing an "Infinite Financial Policy" however wound up composing them a bad Whole Life insurance coverage policy, or perhaps worse, some sort of Universal Life insurance coverage policy, whether it was a Variable Universal Life insurance plan or an Indexed Universal Life insurance policy.

Privatized Banking Concept

An additional threat to the concept came because some life insurance agents began calling life insurance policy plans "banks". Mr. Nash's son-in-law, David Stearns, still runs the company Infinite Financial Concepts, which amongst various other things, sells the publication Becoming Your Own Banker.

IBC is often called "unlimited" due to its adaptable and multifaceted strategy to personal financing management, specifically with the use of entire life insurance coverage plans. This principle leverages the cash money value element of entire life insurance plans as a personal financial system.

This access to funds, for any kind of reason, without needing to get approved for a loan in the typical feeling, is what makes the principle seem "infinite" in its utility.: Using policy lendings to finance organization liabilities, insurance coverage, fringe benefit, and even to infuse capital into collaborations, joint endeavors, or as a company, showcases the adaptability and infinite potential of the IBC.

As constantly, use discernment and follow this advice from Abraham Lincoln. If you are interested in unlimited banking life insurance coverage and remain in the marketplace to get a great plan, I'm prejudiced, but I suggest our household's business, McFie Insurance coverage. Not just have we concentrated on establishing good plans for usage with the Infinite Banking Concept for over 16 years, yet we also own and make use of the very same kind of plans directly.

Uob Privilege Banking Visa Infinite

In either case obtaining a consultation can be invaluable. Our family's firm, McFie Insurance policy, offers an independent insurance policy review absolutely free. Get in touch with us today if you want making sure your policy is properly designed and functioning for you in the proper ways. Whole Life insurance is still the premier economic property.

I do not see that altering anytime quickly. Whether you want discovering more about unlimited financial life insurance policy or wanting to begin using the idea with your very own policy, contact us to schedule a free method session. There's a whole lot of complication around money; there's so much to recognize and it's discouraging when you don't recognize sufficient to make the best economic decisions.

Find out more about the limitless banking principle and just how to begin with unlimited banking. Infinite Banking principle focuses on an individual that becomes their very own lender by gathering fluid cash value within a properly designed long-term life insurance policy policy. You obtain money versus it to pay or invest. Simply put, you are your very own banker.

Table of Contents

Latest Posts

Your Own Banking System

Bank On Yourself Problems

How Do You Become Your Own Bank

More

Latest Posts

Your Own Banking System

Bank On Yourself Problems

How Do You Become Your Own Bank